This platform has just about everything a forex trader could want in terms of market analysis, programmable automated trading, and the availability of third party trading software and custom indicators. The STP NDD brokerage model gives you access to plenty of liquidity across all the liver markets with competitive spreads for the most part. All this combines to make Alvexo an easy recommendation for traders of all skill and experiences levels. If any of this has sparked your interest, we recommend giving it a go.

Features at Alvexo

Such securities generally offer a lower return on investment (ROI), since income is pledged. The fill price is the execution price of a securities or commodities order, agreed alvexo forex broker upon by the buyer and the seller, once the transaction has been completed. Basic goods usually used as inputs in the manufacture of products or provision of services.

Risk Management:

While a proprietary platform shows dedication to provide a better trading environment for clients, it needs to surpass what is available to offer a competitive edge, not simply equal what is offered elsewhere. What stands out is that over 79% of traders operate portfolios at a loss with Alvexo; this is at the upper-end of the spectrum, though not all brokers publish this information. A company with a contracted supplier and an agreement to pay monthly sums in a foreign currency benefits from an FX swap, as their cost remains unchanged regardless of the exchange rate.

What Is the General Trading Calendar?

In foreign exchange trading, the transfer of positive interest differential in the investor’s favour to his/her account following a successful transaction (closing a position). I respect how the broker puts such a strong emphasis on offering industry leading customer support to help you thrive. There is a knowledgeable customer support staff who understand the importance of prompt and efficient responses to all of your requests. They welcome all of your general and technical questions via an online form, telephone and email.

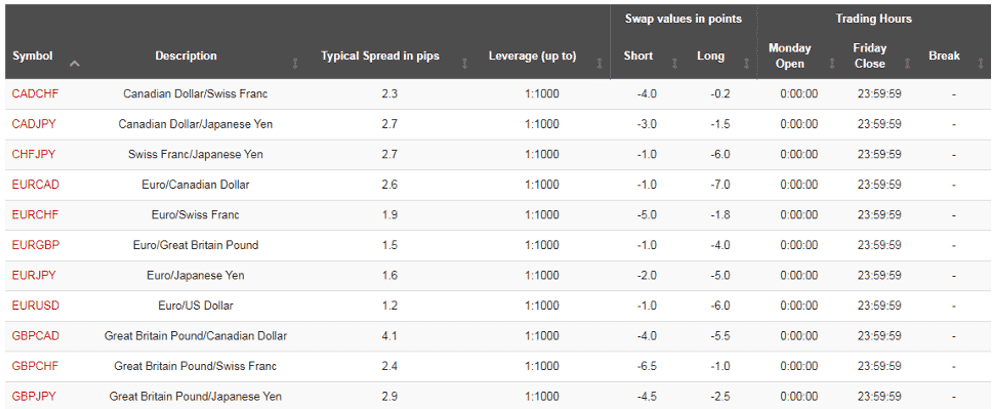

Forex Spreads & Bonuses

Investors can invest in stocks, bonds, indices and other assets on stock-markets, in options and futures at a futures exchange, or foreign currencies in the forex market. What’s best is that nowadays they can do most of this online, from the comfort of their homes, on the train or even vacationing abroad. Alvexo is an established and regulated online broker offering 450+ assets to trade on flexible trading platforms with competitive fees. They provide a variety of account types along with a range of trading tools and trading academy. Additionally, to bestow upon its clients the ability to diversify their portfolios as much as possible, it has made available 450+ financial instruments on its platforms. These include currency pairs, shares, cryptocurrencies, commodities, indices, and last but not least, bonds.

- The account type that you opt for will determine your trading conditions and the duration of the services available to you.

- Alvexo offers the MT4 trading platform, as well as its WebTrader platform.

- It’s a term that represents the decentralized market for foreign currency trading.

- Alvexo is one of the notable online trading platforms founded in 2014 with a crystal-clear aim to empower and educate traders that chose to trade with them.

- I thought that the articles were in-depth and appreciated how they are covering a variety of markets with technical and fundamental analysis.

- The most pertinent are those released on a regular basis by government agencies regarding inflation, GDP, employment and prices of major commodities (such as crude oil).

How are commodities traded?

Borrowing (usually money) at a comparatively low interest rate, then converting it into another currency that offers a higher interest rate, and depositing it for interest. Alternately, one may invest in financial instruments or real estate that also offer a higher yield than the currency borrowed. A broker might have the best assets and trading/non-trading fees, https://forexbroker-listing.com/ but that doesn’t amount to anything if clients feel like their funds are at risk of being stolen. Alain Baradhi, from the United Arab Emirates, spells out in all caps “DO NOT TRUST” Alvexo because he claims that the company is a scam and “fake”. He highlighted that their marketing team was poorly trained and offered bad advice which made traders lose their money.

Foreign exchange rates between any two currencies is a function of supply and demand for each currency. Many factors influence supply and demand, including interest rates and inflation in related countries. Ignoring other factors, if demand for the US dollar by Japanese traders increases, the USDJPY pair will also increase, for example. However, some currencies are not a result of this function, but rather are pegged to a certain value by a government that holds large reserves of the currency in question. Volatility is an indication of investment risk, denoting uncertainty in an asset’s future price typically expressed in percentage form. The difference between the buy (bid) and sell (ask) prices – the moneychanger’s or broker’s profit.

The Alvexo trading academy has a selection of fun and easy to digest trading videos that can help you to learn some of the essentials of trading. Topics include technical analysis, types of markets, charts and more. I enjoyed browsing through each of the videos but I didn’t actually learn anything new as they only really cover the basics.

There are many advantages to trading futures, the biggest of which is flexibility. The many different kinds of trades available to open mean that there is a strategy to fit every scenario, making futures a top choice among experienced investors. Additionally, most futures markets are open 24/7 and besides being extremely liquid, have very low commissions. Options are contracts that give the right, but not the requirement, to the contract holder to exercise his or her position at any time.

Our research focuses heavily on the broker’s custody of client deposits and the breadth of its client offering. Safety is evaluated by quality and length of the broker’s track record, plus the scope of regulatory standing. Major factors in determining the quality of a broker’s offer include the cost of trading, the range of instruments available to trade, and general ease of use regarding execution and market information. One pip represents 1/10,000 of a point in every currency except the Yen, where it represents 1/100 of a point.

Trading Contracts for Difference (CFDs) involves a significant risk of loss that may not be suitable for all investors. Since Forex trading doesn’t require a physical location, it is easy to trade over electronic platforms. All that is required is the presence of buyers and sellers – which is facilitated by these regulated trading platforms.

You should consider whether you understand how derivatives work and whether you can afford to take the high risk of losing your money. Alvexo proudly hosts over 370,000 members on its many platforms and is regulated & authorized by competent regulatory authorities like the FSA and CySEC, ensuring that its financial services are legalized. The different languages offered on its platform really do simplify trading for its clients that originate from 40+ countries. With a Prime Account title, it is possible for you to benefit from even lower spread rates – which are now from 1.8 pips. Finally, the number of support lessons per month offered to Prime Account holders is 5.

Under this broker model, Alvexo does not act as a market maker or take on positions from clients itself, so that substantially reduces their conflict of interest with clients. On the downside, that benefit gets somewhat offset by the volume-based commissions that the broker charges for three of their account types. Only their Classic accounts have no commissions, although clients typically pay a considerably wider dealing spread to compensate the broker. Alvexo offers a lot when it comes to choice, at least with accounts, both STP and ECN accounts are available to choose from. Spreads can be quite high when it comes to the lower-tier accounts, and the commission is quite high when it comes to the ECN accounts, so the only accounts really worthwhile are the mid-tier ones.

You have both minor pairs like the Euro vs Japanese Yen (EUR/JPY) and also major ones such as the USD/CAD, AUD/USD, and NZD/USD to choose from. Traders can also choose to remain connected to their trading account and the global markets by using the MT4 App. The app offers a powerful and intuitive interface that allows you to buy and sell a wide variety of assets directly from the convenience of your mobile device. Alvexo provides real-time market quotes and price feeds to help render your trading experience even more effective and accurate. As in every exchange of goods, there’s a spread, which is the difference between the buy and sell rates of assets. But other than that, you get access to the trading platforms for free; there are no commissions; and what you make is yours to keep.

In Forex, this usually refers to when limit or stop loss orders are executed at a worse rate – usually as a result of unexpected news or market volatility. Realized gains and losses can be used in accountancy as an offset tool in calculating taxes owed on income. Unrealized (paper) gains and losses are profits and losses not realized, so long as the assets or derivatives are held and not executed, and used to calculate potential exposure to taxation. The difference between the highest and lowest values of an asset during a specific trading session.

Share your thoughts